Economic outlook for 2013 remains fairly positive

As China sees the official transfer of power from the outgoing regime to the new government led by Xi Jinping, it seems that economic expectations remain fairly high for 2013.

It was announced in March that the country’s policymakers are standing by their GDP growth target of 7.5% for this year. This comes after a significant slowdown in economic output in 2012, and is seen by many commentators as a reasonable target given the uncertainty in the eurozone and the internal economic issues China faces in the coming year.

According to the Chinese Customs Administration, in late February the number of overseas shipments had grown by 21.8% from a year earlier. Additionally, industrial output increased by 9.9% in the first two months of 2013, whilst retail sales grew by 12.3%.

Although these figures are below what some economists had predicted, they are nevertheless encouraging given the external difficulties of the global economy. In a report published on 11 March, Standard Chartered economists Stephen Green and Wei Li stated that although this economic data was “a bit soft”, they “remain upbeat on China’s recovery”. The report even goes as far as to suggest that the country’s GDP growth rate could surpass 8% this year.

On the whole, economists and investors seem to be increasingly optimistic about the outlook for China. Morgan Stanley’s notoriously outspoken former Asia chairman Stephen Roach argues that China’s economy probably “hit the bottom” in late 2012, and it will now turn the corner towards a more sustainable domestically driven model of development. In an interview with China Daily, he claimed that “the debate is over: China has now set its strategy on the shift to a consumer-led growth model”.

Whether or not the new government will move quickly to implement policies which lead to a dramatic transformation of China’s economic model remains to be seen. With global economic turbulence weighing heavily on China’s reliance on exports for growth, it is likely that bold policy steps will be needed to stimulate demand and maintain the GDP projections for 2013.

Real estate prices back on the up

Key indicators are showing that commercial and residential real estate prices surged across many major cities during the first quarter of 2013. A report by the National Bureau of Statistics showed that property prices rose sharply in 70 of the 60 major cities in China. Between January and February this year, prices in Guangzhou rose by 8.2%. Beijing and Shenzhen were close behind with monthly increases of 7.7% and 5.8% respectively. Tao Hongbing, president of Gaoce Real Estate, told China Daily that “the key reason triggering this round of price hikes is limited supply”.

Whilst bullishness for residential real estate seems to be on the rise, profits in the commercial and office sectors are also improving. Soho China Limited, the country’s largest prime real estate developer, recently announced a doubling of earnings in 2012, and CEO Zhang Xin told Bloomberg news that they are expecting a continued upward trend in the “deep demand for office space in Beijing and Shanghai”.

However, the recent run up in real estate prices may well be short lived. As part of the government’s ongoing attempts to ease speculation in the real estate market, it was announced on 1 March that anyone who sells their home within 5 years of buying it could face a 20% capital gains levy.

Inward investment looks set to increase

Ministry of Commerce (MOC) spokesman Shen Danyang told Xinhua that foreign direct investment (FDI) has risen significantly early in the year. The figures released for February showed an increase of 6.32% for FDI into China from a year earlier. According to Shen, the MOC’s “general estimate is that FDI will remain steady for the whole year, which means significant rises and drops are not likely”.

Whilst policies and initiatives to encourage the inflow of foreign investment into China are slowly working in the country’s favour, the rate of investment from international parties is varying significantly across different sectors of the economy. The amount of foreign money being poured into the country’s service sector, for example, grew by 5.49% in the first two months of the year. Conversely, FDI levels for areas such as manufacturing and agriculture have fallen sharply.

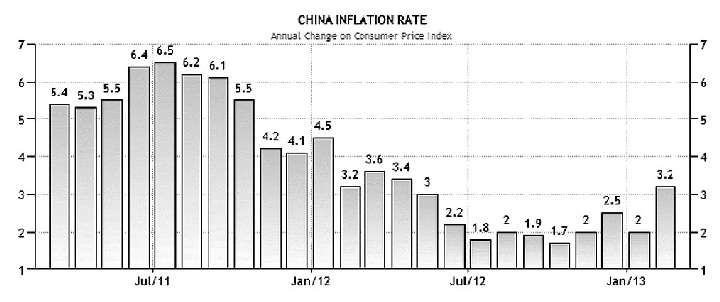

Signs of inflationary pressure building up

Recent reports have indicated that inflationary pressure could potentially destabilise China’s economic recovery in the coming months. The official inflation rate for February was 3.2%. Yet the government announced in early March that they have revised their inflation target for the year down to 3.5%- as opposed to the 4% that was set earlier in the year.

Whilst these rates seem fairly moderate in comparison to those of 2011-12, a sudden surge in inflation over the coming months may prompt policy moves that are damaging to the broader economic revival. Bloomberg economist Michael McDonough points out that “A modest economic rebound in China is likely to push inflation higher as the year progresses, potentially threatening the new target”. He also suggests that if this is the case then it will “reduce room for pro growth policies”. If Beijing does decide to raise the RRR (Reserve Requirement Ratio) to combat inflationary pressures, as they have done several times in recent years, it will ultimately tighten up capital markets and reduce the overall levels of investment in the private sector.

This is in the event that inflation spikes above and beyond the government’s targets, which most economists seem to be suggesting is quite unlikely. Sun Junwei, chief economist at HSBC, claims that February’s inflation rates were “only temporary”, and that his company are convinced that inflation will fall below 3% in the second half of the year as consumer prices fall. Only time will tell.

By Tracy Hall